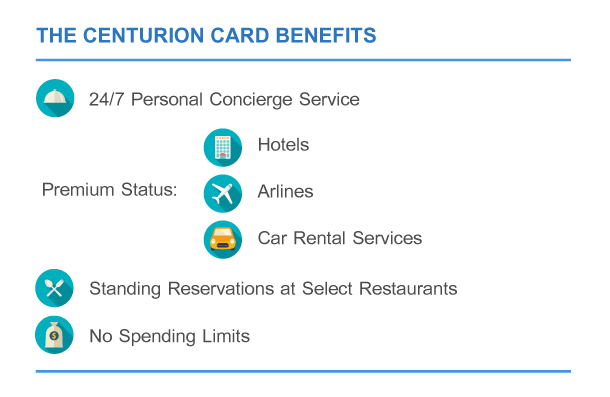

These benefits, in many cases, more than pay for the exorbitant cost and fees. There are extensive benefits associated with the Black Card. Benefits of the American Express Black Card This includes the Gold Card, Green Card, Blue Card, and business versions of both. Many of their “color” focused cards are charge cards. This isn’t a new thing for American Express. Essentially, there’s no APR associated with this card.

#CENTURION CARD BENEFITS FULL#

What this means is that the balance on the Black Card needs to be paid in full each month. On the contrary, it is technically a charge card. It’s imperative to note that the American Express Black Card isn’t a credit card. However, it’s near impossible to be recommended for a Black Card if you lack a strong credit score. Having a healthy credit score (personal or business) in no way guarantees a Black Card invitation. What Is A Business Credit Score? Business Effects and More.Improve Personal Credit Score, Impact Business Credit Score.Here are a few resources we offer about this topic: However, to reach that level, we recommend taking the necessary steps to improve credit scores. To be honest, if numbers such as this come at a shock to you, you likely aren’t ready for the responsibilities that come with Centurion Card ownership. Paying over $10,000 just to get a card may seem insane. This is followed by a $5,000 annual fee to keep the card in good standing. There are extensive associated fees, annual charges, and more associated with the use of this card.Ĭurrently, the Black American Express Card’s initiation fee is a hefty $10,000. If you happen to be one of the lucky few invited to apply for the Black Card, it’s only the beginning. The American Express Black Card, or Centurion Card, comes at a cost, as should be expected. While this may seem excessive, another potential trigger point for card invitations is an annual income of over $1 million. From several reports, spending on credit cards to the tune of $250,000 or more each year is typically looked at.

One of the most common indicators that trigger Black Card invitations is extensive purchase histories. This is perfect for business owners, large and small. Remain active with your card(s), especially American Express-branded cards.

#CENTURION CARD BENEFITS FOR FREE#

While this is an effective strategy for free travel, it doesn’t bode well for one of the main factors that contribute to Black Card eligibility. As a result, their cards are most commonly used for travel reward churning purposes.

American Express is notorious for substantial introductory bonuses as well. Eventually, while the card may not be canceled, it may be marked as inactive. Many who practice tactics like credit card churning will keep a card for introductory bonuses, then move on. If American Express can see a track record of loyalty of consistent card uses, your chances of invitation will surely improve. Having other American Express cards serves to put you on the financial service company’s radar.

#CENTURION CARD BENEFITS HOW TO#

How To Get The American Express Black Card Finally, we explore three alternative card options for those looking for something a little different.

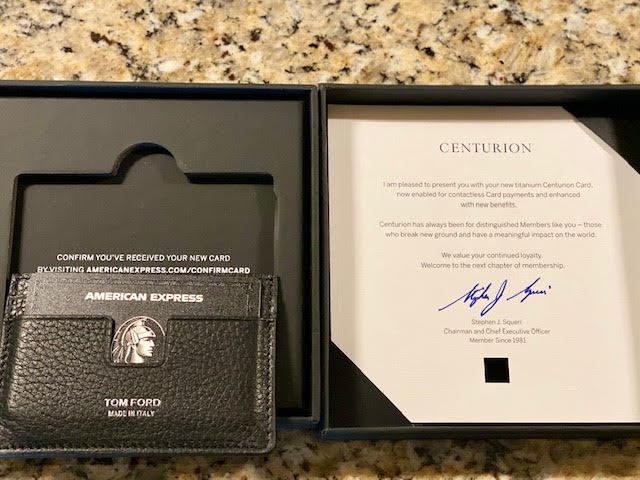

We also explore the costs associated with card ownership and the benefits it provides. Below, we dig into the methods to obtain this secretive card. While it may appear to be nothing more than a status symbol, digging deeper opens a world of opportunity. You won’t find a stronger list of perks and benefits with any other card in existence today. What Is The Importance Of The Black Card?įor those who travel extensively and want to max out convenience when jetting about, the Black Card is ideal. Thus, the American Express Black Card was born in 1999. However, we decided to capitalize on the idea”. Per Doug Smith, American Express Europe’s director at the time: “Rumors were going around that American Express had an ultra-exclusive black card for our elite customers. Before 1999, it didn’t even actually exist! The history of the Amex Black Card is quite unusual.

0 kommentar(er)

0 kommentar(er)